CONTACT

01

Gusto

San Francisco, CA

Gusto is a comprehensive payroll services provider that offers small businesses the best payroll services. With an intuitive and user-friendly platform, Gusto makes it easy to calculate, remit, and pay taxes on behalf of employees, compliant with all labor laws in the United States and applicable to both large and small companies. The pricing structure is straightforward, allowing you to easily budget costs each month without any surprises or hidden fees. Additionally, Gusto provides direct deposit and automated tax filing, creating high-quality solutions tailored to fit the needs of any sized business.

02

Papaya Global

New York, NY

Papaya Global is a revolutionary payroll and payment solutions provider that caters to the needs of small businesses in the US. It offers an array of services, such as a global workforce platform, an employee portal, data security, GDPR compliance, global payments, and more. Papaya’s comprehensive suite of tools allows companies to manage their payroll processes efficiently and effectively while also ensuring compliance with all applicable regulations. Additionally, its global coverage feature enables businesses to pay employees in 160+ countries quickly and securely. The company's commitment to innovation was recently recognized by TIME100's Most Influential Companies 2023 list, where it was named one of the 100 most influential companies for the year. Papaya Global is undoubtedly an invaluable resource for small businesses looking for streamlined payroll solutions in today's digital age.

03

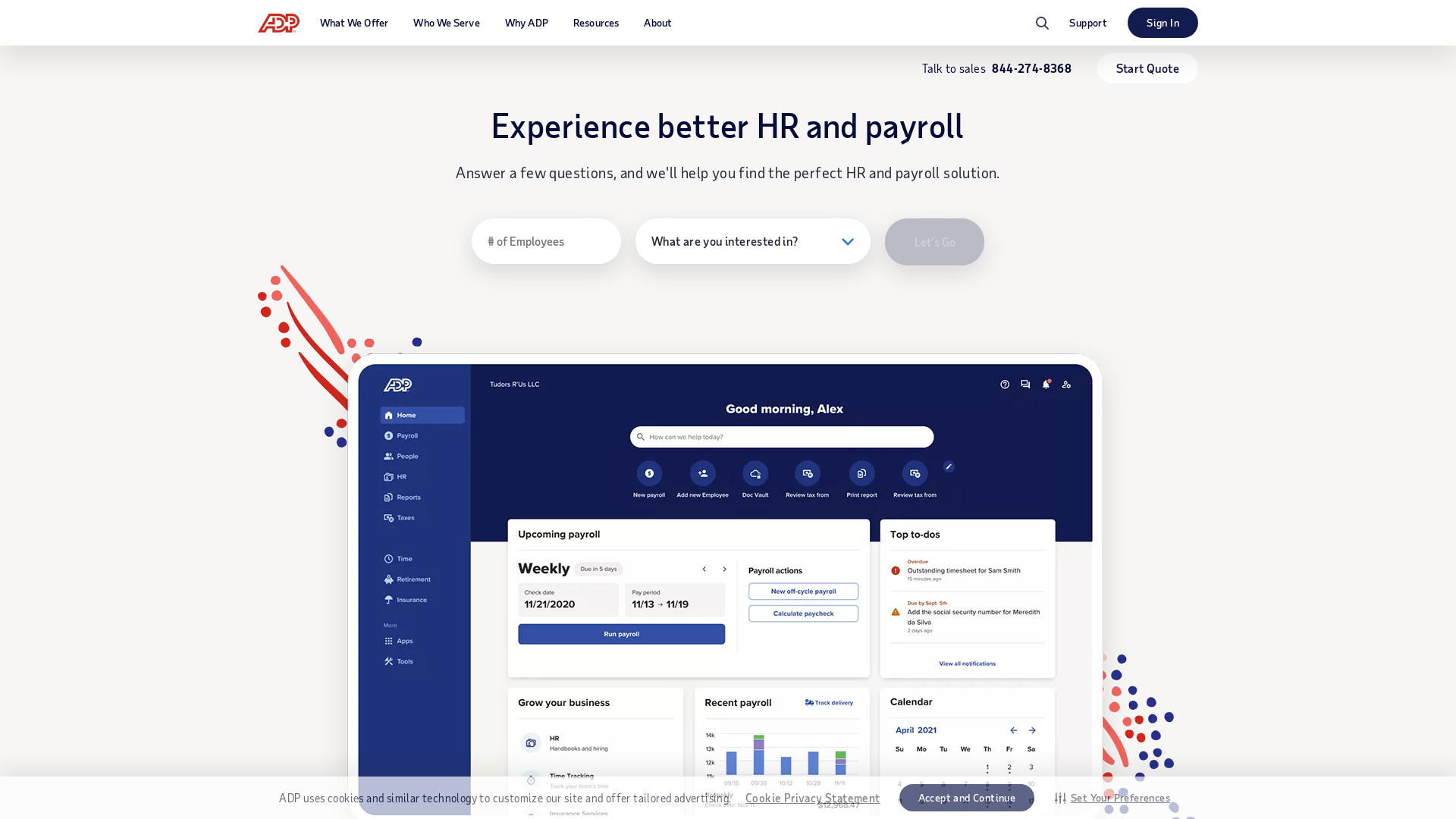

ADP

Roseland, NJ

ADP is a well-known and trusted company offering efficient payroll services for small businesses in the US. They provide an easy-to-use system that enables business owners to accurately manage their payroll and tax needs. ADP's Small Business Payroll package is tailored to meet the unique needs of companies with 1-49 employees, helping them save time by automating processes such as time and attendance tracking, tax filing, and benefits administration. Additionally, they offer helpful features, such as workforce management tools, which allow employers to forecast labor costs and optimize scheduling. For those looking for comprehensive HR solutions, ADP also offers Talent Management Services, which cover everything from recruitment to retirement planning. All of these services come together in one convenient package, making it easy for small businesses across the US to streamline their payroll operations with confidence.

04

Square

San Francisco, CA

Square is an excellent payroll service for small businesses in the US, offering a wide range of features and tools. From POS software and hardware solutions to personalized suggestions and automatic email and text marketing campaigns, businesses can access cash flow management, full-service payroll and benefits, banking features built-in, customizable setup with Square integrations, as well as eCommerce platforms such as WooCommerce or Faire. This comprehensive suite of tools works smarter for businesses, providing customers with best-in-class experiences wherever they shop - in person, on social media, or online. There's no better way to manage your staff than with Square's reliable payroll services!

05

QuickBooks

Mountain View, CA

QuickBooks is the perfect payroll service for small businesses in the US. With their 50% discount over three months and free setup, it is a great way to get your business off to the right start. Its advanced accounting features track income and expenses automatically, while QuickBooks Payments makes it easy to accept credit cards and bank transfers. You can also get tax deductions with ease, customise reports to suit your needs, capture receipts, track mileage, forecast cash flow and more - all in one place! Plus, they offer support topics for those who need assistance getting started or have questions about their services. In conclusion, QuickBooks provides excellent payroll services that are simple to use yet powerful enough for more complex businesses.

06

XcelHR

Rockville, MD

XcelHR offers an innovative payroll solution for small businesses in the US. Their comprehensive HR services cover all aspects of personnel management, from automating payroll and tax filings to providing access to employee benefits plans and recruiting solutions. Businesses can also take advantage of their professional development training programs, risk management advice, and workplace safety protocols. With over 25 years of experience in helping small businesses, XcelHR is the perfect choice for any business looking to optimize profits and secure a successful future.

07

Patriot Software

Canton, OH

Payroll Services for small businesses can be a complex and time-consuming process, but Patriot Software simplifies the job. With their US-based customer support, low prices, and quality services, they provide an ideal solution for small businesses. The software is remarkably easy to use; users report that it only takes them a few minutes to complete tasks like invoicing customers or tracking money. Plus, their automated tax rate updates help you stay compliant with local laws. All in all, Patriot Software offers comprehensive payroll services at a great value – perfect for any small business!

08

Green60

Newport Beach, CA

Green60 Payroll Service is a reliable and comprehensive payroll service designed for small businesses in the US. Their services include payroll processing, white label programs, affiliate programs, certified payrolls, GPS time clock apps, nanny payrolls, W9 & 1099 processing, and benefit/worker’s compensation management. They also offer remote IT support requests and technician portals. With Green60's convenient service and guaranteed low prices—along with their helpful customer support team who can answer all of your questions, no matter what language you speak—this company is a great choice for any small business owner looking to manage their payroll needs quickly and easily.

09

NNRoad

San Jose, CA

NNRoad is a fantastic choice for small businesses looking to expand globally without the hassle of setting up a local entity. They provide comprehensive global payroll services with all currencies supported, and their digital onboarding system makes it easy to hire anywhere. Their employer of record service also offers full compliance coverage in over fifty countries, as well as ground support, so you can rest assured that your employees are being taken care of. On top of this, they guarantee consolidated invoices, which make tracking expenses easier than ever before. In short, if you're looking for an efficient and compliant way to hire globally, NNRoad is the perfect solution.

10

PayTech

Scottsdale, AZ

PayTech is an Arizona-based payroll company that has been serving small business owners for more than 30 years with award-winning HR, payroll, and accounting services. Their streamlined process offers accuracy, efficiency, and real-time reporting so businesses can stay on top of their payroll needs. They provide a wide range of services, such as time and attendance tracking to ensure everyone is paid accurately and on time, paperless options to help reduce office clutter and expenses, as well as free HR support to protect against any potential audits or lawsuits. With their competitive pricing packages and knowledgeable staff, they are the perfect choice for any US-based small business seeking professional payroll solutions.

FAQ

Key questions to consider before hiring a payroll service for your small business

How long has the payroll services provider been in business?

When considering the longevity of a payroll services provider for small businesses, it's critical to consider the company's history; the duration of their operation can often be indicative of their experience, stability and ability to adapt to changes in the market and regulatory environment. A company with a long history in the payroll services industry, for instance, has likely navigated various economic cycles, tax law changes, and technological advancements; this longevity can suggest that they are adept at managing challenges and are equipped to provide reliable service to their customers.

Moreover, a provider that has been in the business for a significant period may have had the opportunity to refine its processes, improve its services, and build a strong reputation; these factors can contribute to better quality service for your small business. However, it's also crucial to note that a newer company may bring innovative approaches and technologies to the table, so while longevity is important, it should not be the sole deciding factor. It's advisable to consider other factors like the company's reputation, customer reviews, the range of services offered, and their pricing structure. Ultimately, the goal is to select a payroll services provider that best suits your unique business needs; longevity is just one piece of the puzzle in the complex decision-making process.

What type of payroll software do they use and how user friendly is it?

The type of payroll software used by a company in the payroll services for small businesses space can significantly impact the user experience; it’s a critical component in the decision-making process. Companies may utilize a range of software solutions, from well-known brands like QuickBooks or ADP to bespoke, proprietary systems developed in-house. User-friendliness is a subjective factor; however, it largely depends on factors such as seamless navigation, readily available support, and the intuitiveness of the software interface. The ease of performing key tasks, such as generating payrolls, deducting taxes, and managing employee benefits, should be evaluated. In addition, consider whether the software facilitates compliance with legal and tax regulations, as this is a crucial aspect of payroll processing. To make an informed decision, potential users should look for reviews or perform a trial of the software, ensuring it aligns with their business needs and skill levels. Remember, a system that is user-friendly for one individual may not be for another, so personal experience is key.

Does the service offer specialized support to help me manage my payroll needs?

Yes, many payroll services for small businesses do offer specialized support to help manage payroll needs; this is an essential component of these services. It is important to understand that payroll is not a one-size-fits-all operation; each business has unique needs and complexities, which may necessitate specialized support. Therefore, when evaluating different payroll services, it's crucial to consider whether they provide tailored support to help navigate the intricacies of payroll management. For instance, some providers may offer expert assistance with tax filing, compliance issues, end-of-year forms, and other payroll-related tasks. Additionally, they might provide software tools that automate certain processes, reducing the time and effort needed to manage payroll. These features can be particularly beneficial for small businesses that may not have a dedicated payroll department, making it easier for them to meet their obligations and avoid costly mistakes. Ultimately, the level and type of support offered will vary between providers; thus, it's important to carefully review and compare these aspects when choosing a payroll service.

01

Gusto

San Francisco, CA

Gusto is a comprehensive payroll services provider that offers small businesses the best payroll services. With an intuitive and user-friendly platform, Gusto makes it easy to calculate, remit, and pay taxes on behalf of employees, compliant with all labor laws in the United States and applicable to both large and small companies. The pricing structure is straightforward, allowing you to easily budget costs each month without any surprises or hidden fees. Additionally, Gusto provides direct deposit and automated tax filing, creating high-quality solutions tailored to fit the needs of any sized business.

02

Papaya Global

New York, NY

Papaya Global is a revolutionary payroll and payment solutions provider that caters to the needs of small businesses in the US. It offers an array of services, such as a global workforce platform, an employee portal, data security, GDPR compliance, global payments, and more. Papaya’s comprehensive suite of tools allows companies to manage their payroll processes efficiently and effectively while also ensuring compliance with all applicable regulations. Additionally, its global coverage feature enables businesses to pay employees in 160+ countries quickly and securely. The company's commitment to innovation was recently recognized by TIME100's Most Influential Companies 2023 list, where it was named one of the 100 most influential companies for the year. Papaya Global is undoubtedly an invaluable resource for small businesses looking for streamlined payroll solutions in today's digital age.

03

ADP

Roseland, NJ

ADP is a well-known and trusted company offering efficient payroll services for small businesses in the US. They provide an easy-to-use system that enables business owners to accurately manage their payroll and tax needs. ADP's Small Business Payroll package is tailored to meet the unique needs of companies with 1-49 employees, helping them save time by automating processes such as time and attendance tracking, tax filing, and benefits administration. Additionally, they offer helpful features, such as workforce management tools, which allow employers to forecast labor costs and optimize scheduling. For those looking for comprehensive HR solutions, ADP also offers Talent Management Services, which cover everything from recruitment to retirement planning. All of these services come together in one convenient package, making it easy for small businesses across the US to streamline their payroll operations with confidence.

04

Square

San Francisco, CA

Square is an excellent payroll service for small businesses in the US, offering a wide range of features and tools. From POS software and hardware solutions to personalized suggestions and automatic email and text marketing campaigns, businesses can access cash flow management, full-service payroll and benefits, banking features built-in, customizable setup with Square integrations, as well as eCommerce platforms such as WooCommerce or Faire. This comprehensive suite of tools works smarter for businesses, providing customers with best-in-class experiences wherever they shop - in person, on social media, or online. There's no better way to manage your staff than with Square's reliable payroll services!

05

QuickBooks

Mountain View, CA

QuickBooks is the perfect payroll service for small businesses in the US. With their 50% discount over three months and free setup, it is a great way to get your business off to the right start. Its advanced accounting features track income and expenses automatically, while QuickBooks Payments makes it easy to accept credit cards and bank transfers. You can also get tax deductions with ease, customise reports to suit your needs, capture receipts, track mileage, forecast cash flow and more - all in one place! Plus, they offer support topics for those who need assistance getting started or have questions about their services. In conclusion, QuickBooks provides excellent payroll services that are simple to use yet powerful enough for more complex businesses.

06

XcelHR

Rockville, MD

XcelHR offers an innovative payroll solution for small businesses in the US. Their comprehensive HR services cover all aspects of personnel management, from automating payroll and tax filings to providing access to employee benefits plans and recruiting solutions. Businesses can also take advantage of their professional development training programs, risk management advice, and workplace safety protocols. With over 25 years of experience in helping small businesses, XcelHR is the perfect choice for any business looking to optimize profits and secure a successful future.

07

Patriot Software

Canton, OH

Payroll Services for small businesses can be a complex and time-consuming process, but Patriot Software simplifies the job. With their US-based customer support, low prices, and quality services, they provide an ideal solution for small businesses. The software is remarkably easy to use; users report that it only takes them a few minutes to complete tasks like invoicing customers or tracking money. Plus, their automated tax rate updates help you stay compliant with local laws. All in all, Patriot Software offers comprehensive payroll services at a great value – perfect for any small business!

08

Green60

Newport Beach, CA

Green60 Payroll Service is a reliable and comprehensive payroll service designed for small businesses in the US. Their services include payroll processing, white label programs, affiliate programs, certified payrolls, GPS time clock apps, nanny payrolls, W9 & 1099 processing, and benefit/worker’s compensation management. They also offer remote IT support requests and technician portals. With Green60's convenient service and guaranteed low prices—along with their helpful customer support team who can answer all of your questions, no matter what language you speak—this company is a great choice for any small business owner looking to manage their payroll needs quickly and easily.

09

NNRoad

San Jose, CA

NNRoad is a fantastic choice for small businesses looking to expand globally without the hassle of setting up a local entity. They provide comprehensive global payroll services with all currencies supported, and their digital onboarding system makes it easy to hire anywhere. Their employer of record service also offers full compliance coverage in over fifty countries, as well as ground support, so you can rest assured that your employees are being taken care of. On top of this, they guarantee consolidated invoices, which make tracking expenses easier than ever before. In short, if you're looking for an efficient and compliant way to hire globally, NNRoad is the perfect solution.

10

PayTech

Scottsdale, AZ

PayTech is an Arizona-based payroll company that has been serving small business owners for more than 30 years with award-winning HR, payroll, and accounting services. Their streamlined process offers accuracy, efficiency, and real-time reporting so businesses can stay on top of their payroll needs. They provide a wide range of services, such as time and attendance tracking to ensure everyone is paid accurately and on time, paperless options to help reduce office clutter and expenses, as well as free HR support to protect against any potential audits or lawsuits. With their competitive pricing packages and knowledgeable staff, they are the perfect choice for any US-based small business seeking professional payroll solutions.

Frequently Asked Questions

Key questions to consider before hiring a payroll service for your small business

How long has the payroll services provider been in business?

When considering the longevity of a payroll services provider for small businesses, it's critical to consider the company's history; the duration of their operation can often be indicative of their experience, stability and ability to adapt to changes in the market and regulatory environment. A company with a long history in the payroll services industry, for instance, has likely navigated various economic cycles, tax law changes, and technological advancements; this longevity can suggest that they are adept at managing challenges and are equipped to provide reliable service to their customers.

Moreover, a provider that has been in the business for a significant period may have had the opportunity to refine its processes, improve its services, and build a strong reputation; these factors can contribute to better quality service for your small business. However, it's also crucial to note that a newer company may bring innovative approaches and technologies to the table, so while longevity is important, it should not be the sole deciding factor. It's advisable to consider other factors like the company's reputation, customer reviews, the range of services offered, and their pricing structure. Ultimately, the goal is to select a payroll services provider that best suits your unique business needs; longevity is just one piece of the puzzle in the complex decision-making process.

What type of payroll software do they use and how user friendly is it?

The type of payroll software used by a company in the payroll services for small businesses space can significantly impact the user experience; it’s a critical component in the decision-making process. Companies may utilize a range of software solutions, from well-known brands like QuickBooks or ADP to bespoke, proprietary systems developed in-house. User-friendliness is a subjective factor; however, it largely depends on factors such as seamless navigation, readily available support, and the intuitiveness of the software interface. The ease of performing key tasks, such as generating payrolls, deducting taxes, and managing employee benefits, should be evaluated. In addition, consider whether the software facilitates compliance with legal and tax regulations, as this is a crucial aspect of payroll processing. To make an informed decision, potential users should look for reviews or perform a trial of the software, ensuring it aligns with their business needs and skill levels. Remember, a system that is user-friendly for one individual may not be for another, so personal experience is key.

Does the service offer specialized support to help me manage my payroll needs?

Yes, many payroll services for small businesses do offer specialized support to help manage payroll needs; this is an essential component of these services. It is important to understand that payroll is not a one-size-fits-all operation; each business has unique needs and complexities, which may necessitate specialized support. Therefore, when evaluating different payroll services, it's crucial to consider whether they provide tailored support to help navigate the intricacies of payroll management. For instance, some providers may offer expert assistance with tax filing, compliance issues, end-of-year forms, and other payroll-related tasks. Additionally, they might provide software tools that automate certain processes, reducing the time and effort needed to manage payroll. These features can be particularly beneficial for small businesses that may not have a dedicated payroll department, making it easier for them to meet their obligations and avoid costly mistakes. Ultimately, the level and type of support offered will vary between providers; thus, it's important to carefully review and compare these aspects when choosing a payroll service.